Key Points:

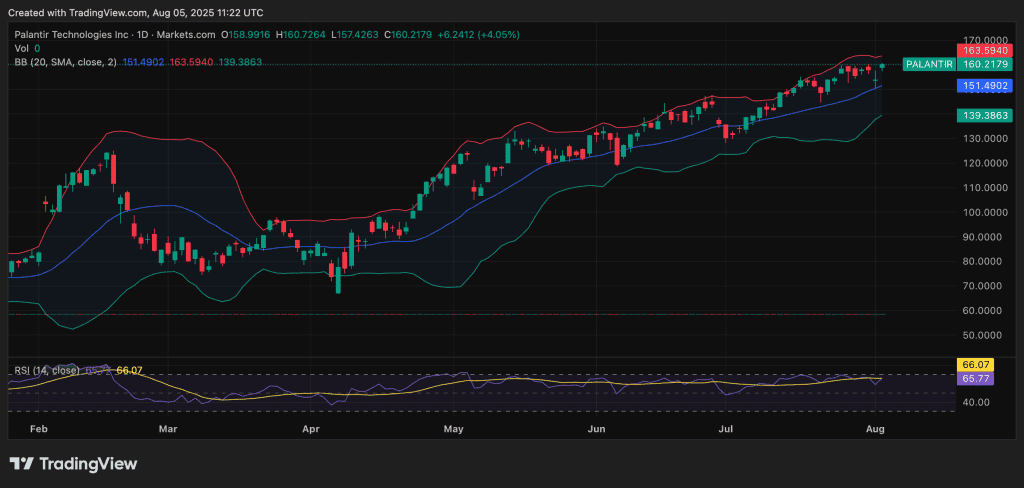

- Palantir shares rose about 6% following strong Q2 earnings.

- Revenue exceeded $1 billion for the first time, up 48% year-over-year.

- U.S. government revenue increased 53% to $426 million; commercial revenue jumped 93%.

- Adjusted EPS came in at $0.16, beating analyst estimates.

- Full-year 2025 revenue forecast raised to $4.14–$4.15 billion.

- Market cap now approaches $380 billion.

- Company awarded a U.S. Army enterprise contract worth up to $10 billion over 10 years.

Palantir Technologies Inc. (NYSE: PLTR) shares surged after posting its first-ever quarter with revenue exceeding $1 billion, marking a 48% year-over-year increase. Adjusted earnings per share reached $0.16, surpassing analyst expectations of around $0.14. U.S. government revenue climbed 53% to $426 million, while U.S. commercial revenue soared 93% to $306 million, highlighting broad-based demand.

AI Integration Accelerates Growth

CEO Alex Karp emphasized the “astonishing” impact of integrating artificial intelligence (AI) into Palantir’s platforms. The company combines AI capabilities with its core data infrastructure to deliver actionable insights and improved decision-making for clients.

Securing a Major U.S. Army Contract

Palantir has been awarded a transformative enterprise agreement with the U.S. Army, consolidating over 75 legacy contracts into a single deal. Valued at up to $10 billion over 10 years, it’s one of the largest software contracts in Department of Defense history. Analysts view the agreement as a major milestone that firmly positions Palantir as a top-tier defense tech provider.

Upgraded Guidance and Market Momentum

Riding on its strong Q2 performance, Palantir raised its full-year 2025 revenue guidance to a range of $4.14 billion to $4.15 billion, ahead of previous projections. The stock’s rally has pushed its market capitalization to nearly $380 billion, reflecting growing investor confidence in its AI-driven strategy and federal government partnerships.

Outlook and Challenges

Despite its momentum, Palantir faces challenges such as international expansion and rising costs. However, its robust results, AI innovation, and landmark Army deal have cemented its role as a key player in both the commercial and defense analytics sectors.