Sponsored Post

Edgeful is a statistics-based trading platform that positions itself as a personal financial analyst, transforming raw market data into actionable insights for traders. The platform provides probability-based strategies backed by historical data analysis, across multiple markets including stocks, futures, forex, and cryptocurrency.

Founder and CEO André Arslanian built the platform to help traders “trade with data, not their emotions.” Before launching edgeful, he worked at Goldman Sachs and created the tool out of his own need for a tailored market analysis system that could turn complex data into actionable trading insights.

Core Concept & Approach

What distinguishes edgeful from traditional trading platforms is its fundamental philosophy. Instead of simply providing charts and indicators, edgeful analyzes up to five years of historical data to show how specific patterns performed in the past. The platform answers questions like “How often does this gap fill?” or “What are the odds this pattern plays out?”, questions that traders spend countless hours backtesting manually.

At its core, edgeful aggregates years of market behavior and distills it into statistical reports, revealing how price typically reacts to common scenarios: gap opens, opening-range breakouts, volatility expansions, mean reversion and news-driven candles. The company helps traders avoid FOMO, emotional tilt, and blown accounts through its probability insights.

Key Features

1. Report Library (100+ Custom Reports)

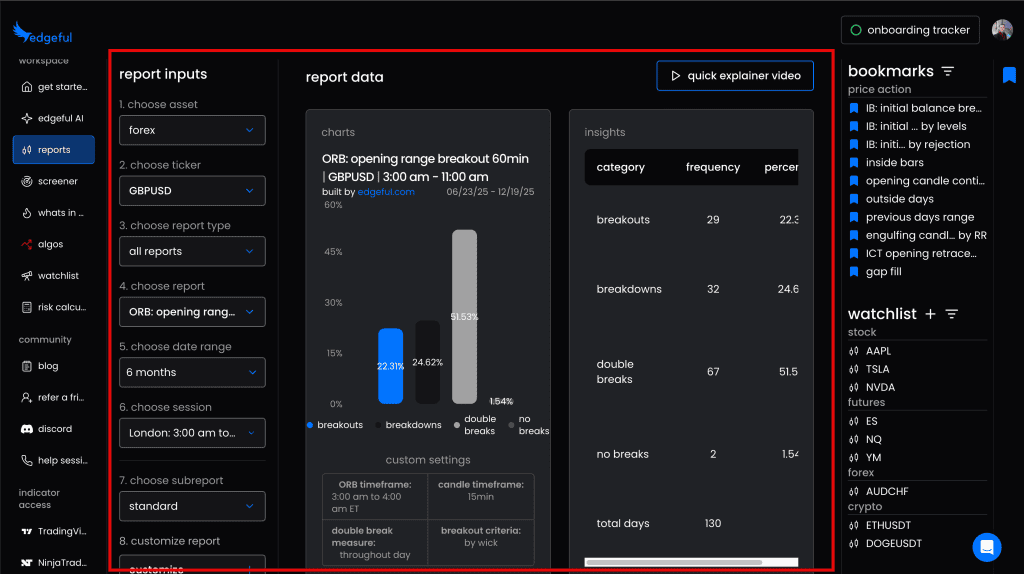

Edgeful Opening Range Breakout (ORB) Report

***

The report library represents edgeful’s central offering. With over 100 custom-built reports covering 3,000+ assets across stocks, futures, crypto, and forex, there’s extensive actionable data available. Reports cover various strategies including:

- Gap fills. The Gap Fill Report breaks down gap behavior with clarity, letting users filter by gap size, weekday, asset class, and trading session (New York, London, etc.), turning a common market concept into a hands-on strategy.

- Opening range breakouts. The Opening Range Breakout turns the opening of the session into a clear, data-backed trading framework, showing how often price breaks up, down, or both. I like to trade the London Opening Range Breakout, so I was excited to dig into the stats for this strategy.

- Initial balance breakouts. The Initial Balance Report is a sharp, session-aware tool that turns the first hour’s high/low into a practical roadmap, showing whether price tends to break one side, both sides, or neither, and how that shifts by session.

- Opening candle continuation. The Opening Candle Continuation Report is a simple but effective bias tool, showing how often the day finishes green or red based on whether the session’s opening candle starts positive or negative.

- Inside Bar. The Inside Bars Report measures how often price breaks out when it opens within the previous session’s range, revealing a strong historical tendency for price to reach the prior session’s high or low and making those levels reliable, data-backed targets across markets and sessions.

Customization capabilities are robust. Users can adjust date ranges, filter by specific weekdays, modify session times, and set custom parameters. This flexibility is particularly valuable for traders with specific schedules. If you only trade the first hour due to a day job, reports can be tailored accordingly.

Edgeful also provides strategies combining multiple reports, like the Ultimate Reversal Setup.

This setup combines three data-backed reports to define both daily bias and high-probability reversal targets. The strategy looks for days when price opens above or below all three key levels: yesterday’s range (using the outside day report), a reference opening price (using the ICT opening retracement report), and the prior session’s close (using the gap fill report), creating strong confluence for mean-reversion.

When all signals align, historical data shows a high likelihood of price reversing back toward these levels, allowing traders to maintain their conviction and manage positions more effectively.

2. What’s in Play Screener

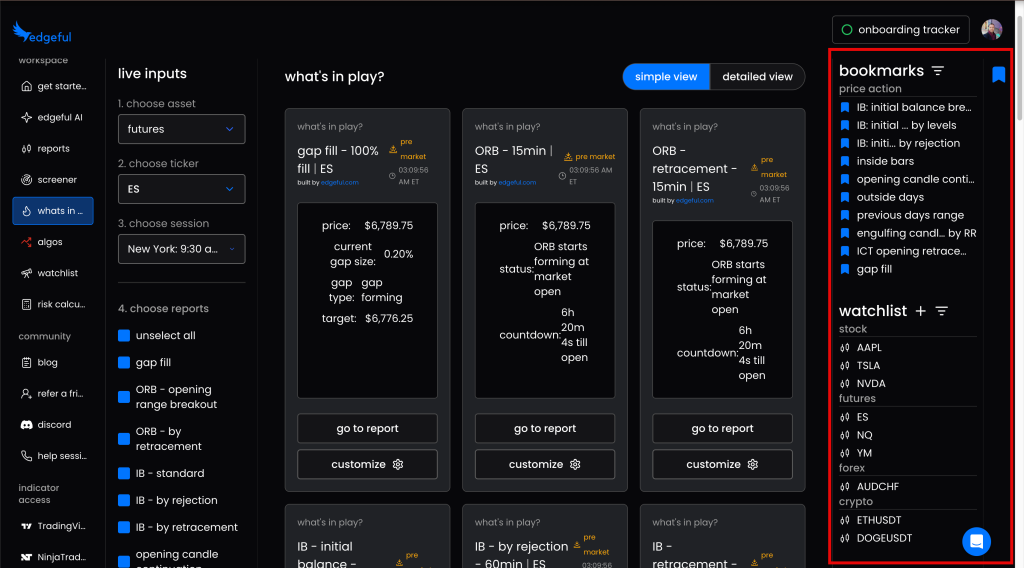

What’s In Play

The screener provides a 360° view across market leaders, monitoring main strategies like Gap Fill, Opening Range Breakout, Initial Balance, and Opening Candle Continuation across all selected tickers. This feature helps traders quickly identify where opportunities are forming and gauge overall market sentiment.

The screener excels at showing directional bias. When all monitored assets show green across strategies, it suggests strong bullish momentum where shorting may be unwise. Conversely, widespread red signals indicate bearish conditions unsuitable for long positions. Mixed signals typically indicate choppy, directionless markets where sitting out may be prudent.

3. Trading Algorithms

Edgeful’s Algo Plan is an upgraded subscription that bundles its data-driven trading algos, currently including Gap Fill, Opening Range Breakout (ORB), and Inside Bar (IB), with new strategies like the Engulfing Candles algo added over time. The plan also includes full broker and prop-firm automation, allowing trades to be entered, managed, and exited automatically without needing to be at the screen.

A core strength of the plan is customization. Each algo can be tailored to your trading personality, risk tolerance, desired win rate, risk-to-reward, position size, and trading days, then optimized through detailed backtests before being fully automated. The plan also includes educational content and access to a private Discord where users share settings and results, helping traders build confidence in data-backed strategies while reducing emotional decision-making.

4. TradingView Integration

Edgeful Market Sessions TradingView Indicator

***

39 free TradingView indicators are included for subscribers, allowing strategies to be visualized directly on charts. These include Power Hour Breakout, ATR Zones, Ultimate Reversal Setup, and Market Sessions indicators.

5. Personalized Dashboard & Watchlists

Personalized Bookmarks and Watchlist

***

The watchlist feature proved essential for efficient navigation, allowing quick switching between preferred tickers without losing report configurations or parameters. Users can bookmark favorite reports and setups for streamlined workflow.

Pricing Structure

- Monthly subscription: $49/month (full access to all reports, data, and indicators)

- Annual subscription: $468/year (20% savings, equivalent to $39/month)

- Algorithm upgrade: $299/month (for advanced algo features)

There’s no free trial and no segmented plans based on trader level, all users receive full access. This simplicity eliminates confusion but may deter traders wanting to test before committing. Based on my experience, I rate the cost as modest in relation to the value it delivers.

Platform Access & Usability

Edgeful is browser-based and accessible from any internet-connected device: computer, tablet, or phone. While there’s no standalone mobile app currently, the web platform is responsive on mobile devices.

The platform also offers broker integrations with Tradovate, NinjaTrader, and Project X. Setup requires only email or Google account registration with no complicated integrations or downloads.

Data Quality & Sources

All reports are built using direct exchange feeds from major exchanges like Nasdaq, CME, Coinbase, and Oanda, ensuring reliable, accurate data. Reports update daily to remain synchronized with current market conditions.

User Experience & Community

Live trading data-backed setups with James Bruce

***

The platform offers pre-market preparations and live trading sessions led by experts. The streaming schedule via edgeful’s YouTube channel includes the following:

- Monday & Friday 9-11AM EST, André & James live trade using edgeful

- Tuesday, Wednesday, Thursday 9-11AM EST, Brice live trades using edgeful

- Wednesday, Thursday, Friday 8-8:30AM EST, James live streams his premarket prep using edgeful

Mentorship and help session calls are also available to edgeful members and can be booked through the edgeful dashboard.

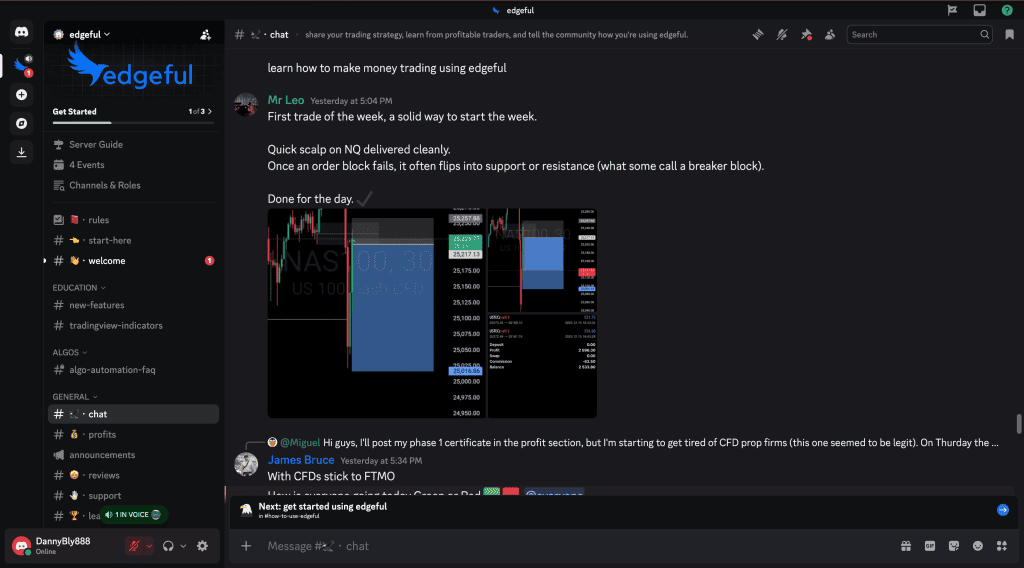

Edgeful Discord Community

***

With over 4,700 members, the edgeful Discord community serves as a hub for disciplined, data-driven traders. Moderators actively demonstrate how to identify high-probability setups using edgeful’s tools, while members share custom settings, strategies, and engage in daily market discussions.

The Discord provides real-time collaboration where traders can learn from others using the same statistical approach, creating an accountability structure often missing from solo trading. Notably, the Discord is free to join even for non-subscribers, making it an accessible entry point for traders curious about edgeful’s data-driven methodology before committing to the paid platform.

Strengths

- Unique value proposition: No comparable platform delivers price action statistics at this scale for retail traders

- Time-saving: Eliminates hours of manual backtesting and spreadsheet analysis

Actionable data: Provides specific probabilities, success rates, and optimal timing rather than vague indicators - Multi-market coverage: Works across stocks, futures, forex, and crypto

- Broker integrations: including Tradovate, NinjaTrader, and Project X

- Customization: Extensive filtering and parameter adjustment options

- Educational support: Webinars, coaching, and community resources

- Fair pricing: Great value considering the depth of analysis provided

- Regular updates: Daily report refreshes and ongoing platform improvements

Limitations

- No free trial: Requires financial commitment without testing period

- Learning curve: Requires some time and effort to master the platform

- Algorithm pricing: The $299/month algo tier is expensive for casual traders

- Browser-only: No native mobile app for on-the-go access

Who Should Use Edgeful?

Edgeful fits traders who think more like quants than gamblers. If you treat markets as probabilistic systems, not casinos, the platform aligns naturally with your workflow.

Ideal for:

- Pattern-based traders seeking statistical validation

- Traders who struggle with emotional decision-making

- Those working to pass prop firm challenges

- Retail traders wanting institutional-level data analysis

- Traders with specific schedules needing customized insights

Less suitable for:

- Discretionary traders who prefer intuition-based approaches

- Complete beginners unfamiliar with basic trading concepts

- Traders unwilling to invest time learning the platform

Final Thoughts

Edgeful represents a genuinely innovative approach to retail trading by democratizing statistical analysis previously available only to institutional players. The company’s mission is to level the playing field by transforming complex data into actionable reports, and I believe it largely succeeds in this goal.

The platform’s greatest strength is turning the question “What do I think will happen?” into “What does the data show typically happens?” This paradigm shift can fundamentally improve trading discipline and consistency. The comprehensive report library, daily updates, and probability-based insights provide genuine edge for traders willing to incorporate data-driven decision-making.

What I liked the most about the plaform is that it goes far beyond providing statistical reports; offering a range of actionable strategies, a community of active traders and even one-on-one training and mentorship to get you up to speed. Having tested the platform for several weeks, I rate edgeful as an excellent tool for both serious beginners and experienced traders looking to expand their strategy repertoire.

📈 Learn more about edgeful at edgeful.com