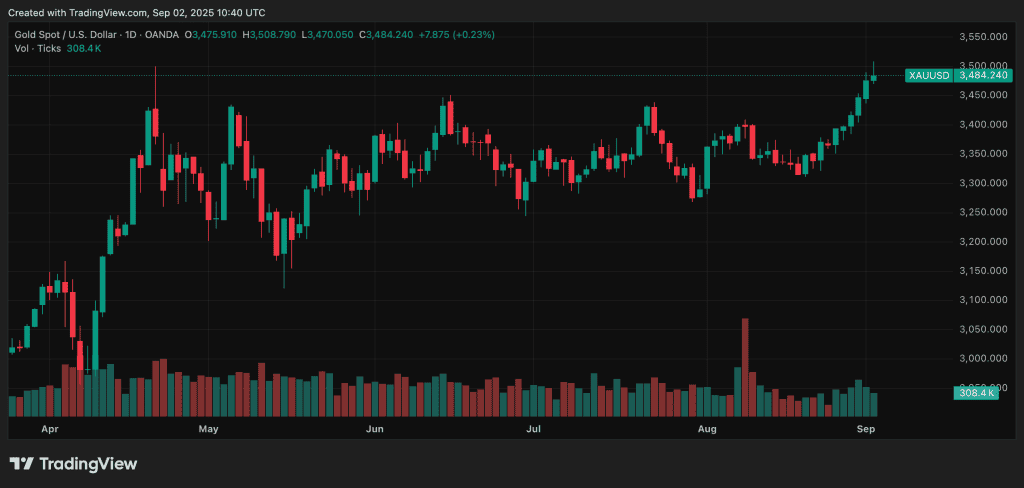

Gold surged to record levels today, rising above $3,500 per ounce, rising above its April high. The rally reflects a surge in safe-haven demand as investors hedge against mounting economic uncertainty. Silver also joined the upswing, trading above $40 per ounce, a level not seen since 2011.

The Role of Federal Reserve Expectations

Markets are increasingly convinced that the Federal Reserve will deliver an interest rate cut as early as mid-September. A softer U.S. dollar has added fuel to gold’s momentum, as the metal becomes more attractive to international buyers. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold.

Central Bank Demand and ETF Inflows

Gold’s ascent is also being supported by steady central bank purchases, with countries such as China, Turkey, and India continuing to diversify their reserves. Exchange-traded funds backed by physical bullion have seen significant inflows, suggesting institutional investors are also increasing their exposure. This structural demand provides a foundation for gold’s ongoing rally.

Geopolitical Pressures and Investor Caution

Political and economic risks are weighing heavily on sentiment. Concerns about the independence of the Federal Reserve under heightened political scrutiny, alongside trade tensions and global growth uncertainties, have encouraged investors to seek refuge in gold. These fears are driving safe-haven flows and reinforcing the bullish momentum in precious metals.

Technical Momentum and Market Outlook

From a technical perspective, gold’s decisive break above the $3,500 threshold has encouraged a “buy-the-dip” mentality among traders. Analysts at leading banks such as Goldman Sachs, are revising forecasts upward, with price targets ranging from $3,700 to $4,000 per ounce. Silver, meanwhile, is projected by some analysts to climb toward $42–$48, highlighting its dual role as both an industrial and safe-haven asset.

Implications for Investors

Gold’s nearly doubling in value since early 2023 underscores its renewed importance as a portfolio hedge. Investors see the metal not only as protection against inflation and currency risk but also as a shield in an increasingly uncertain geopolitical environment. With silver regaining momentum and other commodities showing volatility, precious metals may continue to play a central role in global investment strategies.