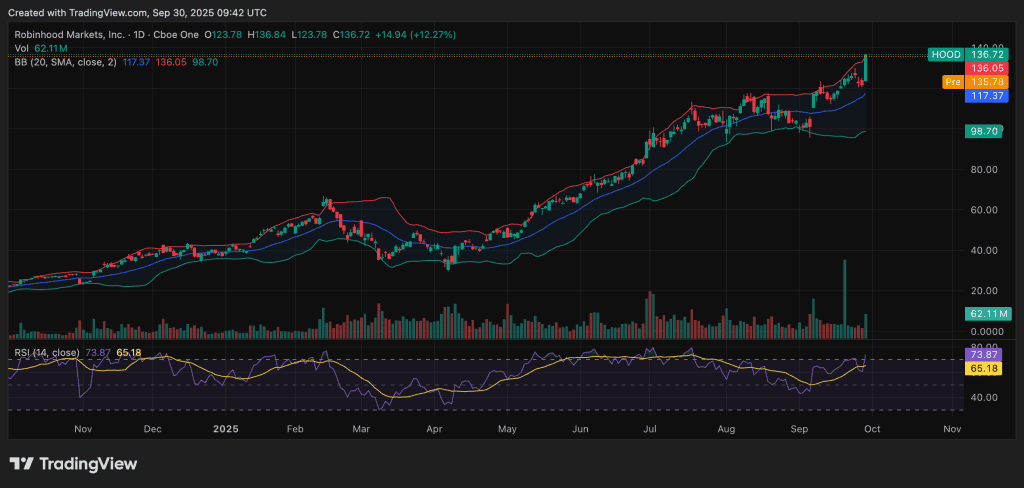

Shares of Robinhood Markets (ticker: HOOD) exploded on Monday, hitting all-time highs and leading gains across the S&P 500. The stock jumped over 12 % intraday and closed at a new record, fueled by strong momentum in its prediction markets business and growing investor confidence.

Key Catalysts Behind the Surge

Robinhood’s rally has been driven by several factors: CEO Vlad Tenev revealed that the platform has traded more than 4 billion event contracts, over half in Q3 alone, underscoring the rapid growth of its prediction markets. The company’s recent addition to the S&P 500 brought significant institutional inflows, making it the top-performing index component of 2025 with gains above 260 %. Analysts have upgraded price targets in response to this momentum, noting Robinhood’s evolution beyond a retail trading app, while a supportive backdrop of strong equity and crypto markets has bolstered optimism.

Risks & Considerations

Despite the record highs, risks remain. Valuations have surged, leaving the stock vulnerable to volatility and potential pullbacks. The prediction markets business, while a standout growth driver, could attract regulatory scrutiny, and Robinhood’s reliance on transaction-based revenue still ties its fortunes to trading activity levels. Insider selling has also emerged, which, although not unusual at these levels, may raise investor caution. Combined, these factors suggest that while Robinhood’s trajectory is impressive, sustaining it will depend on execution and market conditions.

What’s Next

Looking ahead, Robinhood’s ability to sustain its momentum will hinge on expanding beyond trading, with opportunities in prediction markets, banking products, and crypto services. Continued growth could justify its valuation, but volatility is likely as broader market trends, regulation, and competitive pressures shape its path.

Investor Sentiment

The surge in Robinhood highlights the renewed enthusiasm among retail traders and institutional investors alike. Its transformation from a zero-commission trading app into a diversified financial platform has captured market attention, but sustaining that narrative will require continued innovation, regulatory clarity, and consistent revenue growth. Investors now face the challenge of weighing Robinhood’s remarkable momentum against the realities of an evolving business model and the uncertainties of global markets.