Booking Holdings (NASDAQ: BKNG), the operator of Booking.com, Priceline, Agoda, and OpenTable, continues to benefit from renewed global travel momentum. In Q2 2025, the company reported revenue of $6.8 billion, marking a 16 percent year-over-year increase that beat analyst forecasts of around $6.57 billion. Adjusted earnings per share came in at $55.40, up 32 percent from the prior year and above expectations. Gross bookings climbed 13 percent to $46.7 billion, driven by strong international travel, while U.S. demand remained uneven.

Upgraded Guidance

Boosted by its strong Q2 performance, Booking raised its full-year forecast. The company now expects gross bookings to grow in the high single-digit range, compared with the mid-to-high single-digit range previously forecast. For Q3, management projects 7 to 9 percent revenue growth and 3.5 to 5.5 percent room-night growth, a cautious stance reflecting global uncertainties.

Stock Performance Near Record Highs

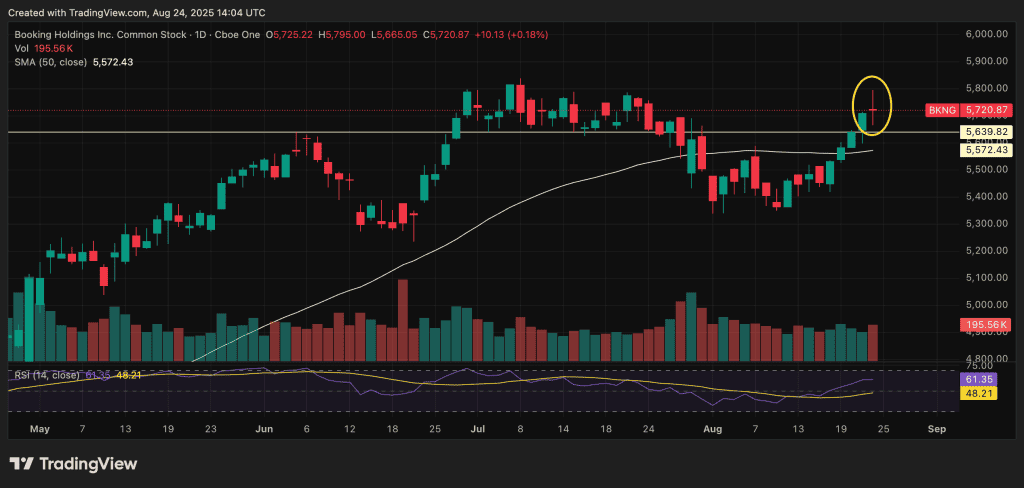

Booking’s share price has responded strongly. It is currently trading near $5,720, only about 2 percent below its 52-week high of $5,839.41, reached in early July 2025. Shares are up 13 percent in 2025 and 50 percent over the past year, comfortably outperforming peers such as Expedia and Airbnb. Analysts note that the stock is approaching a “buy point” at $5,839.41 in a flat base pattern.

Technical Outlook

From a technical perspective, a Doji candlestick pattern appeared on the daily chart last week, signaling indecision among traders as the stock consolidates just under resistance. This formation often reflects a pause in momentum, with buyers and sellers reaching temporary balance. If Booking breaks convincingly above the $5,800 to $5,839 resistance zone, it could trigger a new leg higher toward analysts’ $6,250 to $6,500 targets. On the downside, failure to hold current levels may open the door to a pullback toward near-term support around $5,600.

What is Driving Growth

In addition to travel demand, Booking is benefiting from cost efficiencies and strategic innovation. Q2 delivered approximately $45 million in cost savings, and the company expects $150 million in savings for 2025 with long-term annualized run-rate savings of $350 million. Its Connected Trip initiative, which bundles flights, hotels, and activities into one seamless booking, now accounts for a growing double-digit share of total bookings.

Wall Street Sentiment

Analysts remain optimistic. Erste Group upgraded Booking to “Buy,” while Evercore ISI and JPMorgan raised price targets into the $6,250 to $6,500 range. About two-thirds of covering analysts now rate the stock a Buy, reflecting confidence that it can extend gains.

Conclusion

Booking Holdings is riding a powerful wave of global travel demand. Strong quarterly results, an upgraded outlook, and efficiency gains have pushed its shares close to record highs. The technical setup shows consolidation marked by a Doji pattern, and the next decisive move above or below resistance levels will likely determine short-term direction. Over the longer term, continued global travel recovery and operational discipline keep the company well positioned.